Need help?

+880 9606-224422

Need help?

+880 9606-224422

Need help?

+880 9606-224422

=>1996: Founded as Bahrain Bangladesh Finance and Investment Company Limited.

=>2000: The Mascot Finance Company Ltd. (MFC) from the Sultanate of Muscat, along with other investors, acquired the majority shares of the company. Following this acquisition, the company was renamed as Oman Bangladesh Leasing & Finance Ltd.

=>2003: The overseas investors from Mascot sold their holdings to local investors, marking the transition of the company into a fully local enterprise.

=>2009: In 2009, it was rebranded as Reliance Finance Limited by bringing a significant shift in strategic decision in management, capital base, and operational philosophy.

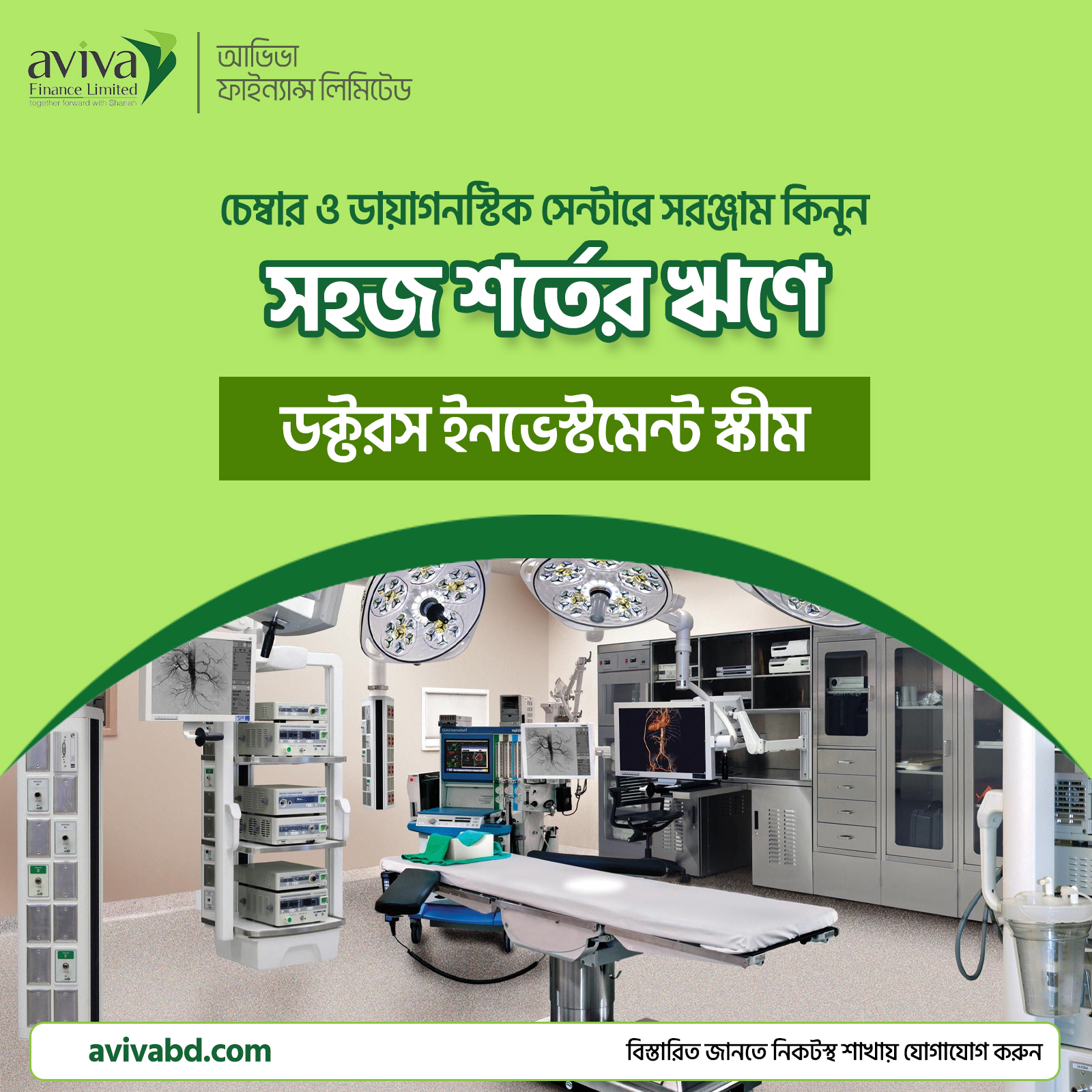

=>2020: In a landmark move on January 28, 2020, Reliance Finance Limited was rebranded as Aviva Finance Limited by transitioning from a traditional interest-based financial institution to a fully Shariah-compliant business

Hic nesciunt galisum aut dolorem aperiam eum soluta quod ea cupiditate.

This agency is the highly recommended by me ever-evolving requires a thorough the understanding the market, strong business is the business This agency is the highly recommended by me ever

This agency is the highly recommended by me ever-evolving requires a thorough the understanding the market, strong business is the business This agency is the highly recommended by me ever

Experiences

Happy Client

Islamic finance follows Shariah law, which prohibits: Riba (interest) Gharar (excessive uncertainty) Haram businesses (e.g., alcohol, gambling, pork) This ensures investments align with Islamic ethical and moral values.

Conventional finance is profit-driven, primarily interest-based, and less restricted in ethical terms. Shariah finance follows Islamic law, which prohibits interest, emphasizes ethical investing, and promotes risk-sharing and real economic activity.

The main sources of Shariah law that guide Islamic finance are: Qur'an The holy book of Islam, considered the primary source of divine guidance. It includes broad principles related to justice, fairness, and prohibitions (e.g., against riba—usury or interest). Sunnah The practices, sayings, and approvals of the Prophet Muhammad (peace be upon him). It clarifies and complements the Qur'an, offering more specific guidance on commercial and financial dealings. Ijma (Consensus of Scholars) The agreement of qualified Islamic scholars on a particular issue. Ijma is used to derive rulings when there is no explicit text in the Qur'an or Sunnah. Qiyas (Analogical Reasoning) The application of established rulings to new cases by finding a common cause or principle. For example, if interest is prohibited in one form of lending, it would be analogically extended to similar financial arrangements. These sources form the foundation of Islamic jurisprudence (fiqh) and guide the structuring of Islamic financial products and services to ensure they are compliant with Shariah principles.

The principle of Profit and Loss Sharing (PLS) is a fundamental concept in Shariah-compliant finance, rooted in Islamic teachings that prohibit interest (riba) and promote ethical, risk-sharing financial transactions.